Consumer Support: Seek out a company that gives committed guidance, which includes access to educated specialists who will respond to questions about compliance and IRS rules.

Increased Costs: SDIRAs often feature better administrative expenses when compared with other IRAs, as certain areas of the executive method can't be automated.

For those who’re hunting for a ‘set and ignore’ investing method, an SDIRA likely isn’t the proper decision. As you are in total Manage in excess of each individual investment made, It is your decision to perform your individual homework. Remember, SDIRA custodians aren't fiduciaries and can't make recommendations about investments.

The tax strengths are what make SDIRAs beautiful For lots of. An SDIRA is usually both traditional or Roth - the account form you select will depend mainly on your own investment and tax approach. Verify together with your monetary advisor or tax advisor in the event you’re unsure which is ideal in your case.

Criminals at times prey on SDIRA holders; encouraging them to open accounts for the purpose of earning fraudulent investments. They normally idiot traders by telling them that In the event the investment is accepted by a self-directed IRA custodian, it needs to be legit, which isn’t real. Once again, Be sure to do complete homework on all investments you select.

Ease of Use and Know-how: A consumer-pleasant platform with online applications to trace your investments, submit documents, and regulate your account is important.

Introducing income straight to your account. Bear in mind contributions are topic to once-a-year IRA contribution limitations established with the IRS.

Have the liberty to invest in Just about any type of asset that has a danger profile that matches your investment strategy; which include assets that have the likely for the next charge check out this site of return.

Selection of Investment Choices: Make sure the service provider allows the kinds of alternative investments you’re considering, including housing, precious metals, or non-public equity.

SDIRAs tend to be used by hands-on buyers who are willing to take on the dangers and duties of selecting and vetting their investments. Self directed IRA accounts can be great for traders who may have specialised knowledge in a niche current market that they would want to put money into.

Building essentially the most of tax-advantaged accounts enables you to preserve additional of The cash that you invest and receive. According to irrespective of whether you decide on a conventional self-directed IRA or possibly a self-directed Roth IRA, you might have the likely for tax-totally free or tax-deferred expansion, offered specified disorders are achieved.

Put merely, in the event you’re seeking a tax efficient way to develop a portfolio that’s much more tailored towards your pursuits and know-how, an SDIRA may be The solution.

Therefore, they tend not to advertise self-directed IRAs, which provide the flexibility to speculate in the broader selection of assets.

An SDIRA custodian is different because they have the appropriate personnel, skills, and potential to take care of custody in the alternative investments. The initial step in opening a self-directed IRA is to locate a company that may be specialized in administering accounts for alternative investments.

Before opening an SDIRA, it’s crucial to weigh the prospective advantages and drawbacks based upon your precise money plans and hazard tolerance.

Complexity and Accountability: By having an SDIRA, you have extra Command about your investments, but You furthermore mght bear far more duty.

In contrast to shares and bonds, alternative assets in many cases are more challenging to provide or can feature strict contracts and schedules.

This consists of knowledge IRS laws, managing investments, and averting prohibited transactions that can disqualify your IRA. A lack of knowledge could cause expensive mistakes.

Be in command of the way you develop your retirement portfolio by using your specialised awareness and interests to take a position in assets that healthy with your values. Received skills in housing or non-public equity? Use it to help your retirement planning.

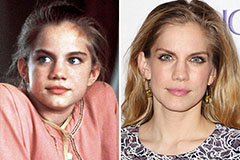

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Kirk Cameron Then & Now!

Kirk Cameron Then & Now! Tahj Mowry Then & Now!

Tahj Mowry Then & Now! Christina Ricci Then & Now!

Christina Ricci Then & Now! Ricky Schroder Then & Now!

Ricky Schroder Then & Now!